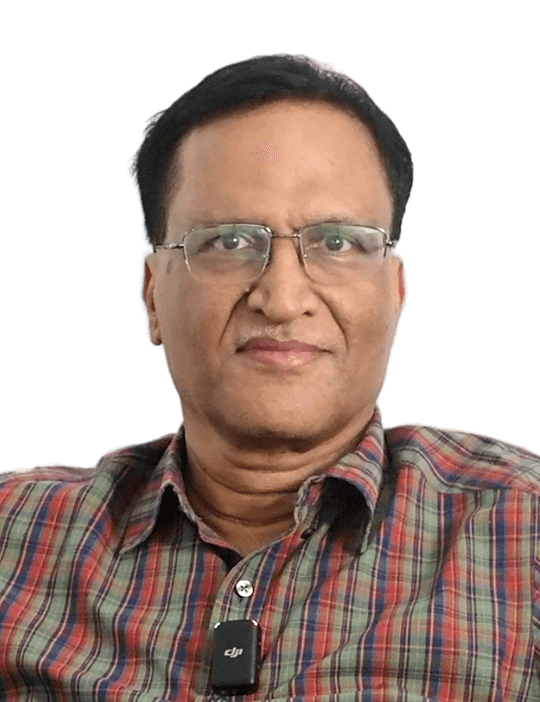

Arbind Modi

Former Ministry of Finance, Government of India

Arbind Modi is an internationally respected tax policy expert with over 40 years of experience in tax reform, revenue strategy, and institutional development. He has advised numerous countries in Asia and Africa as a short-term expert for the IMF and World Bank. In India, he served as Member (Legislation), CBDT; Convener of the Task Force to Rewrite the Income Tax Act (2017–18); and Chairman of the GST Task Force (2007–09). He played a key role in designing the Direct Taxes Code (2009) and India’s GST. A former Senior Economist in the IMF’s Fiscal Affairs Department, he brings deep technical, legislative, and international reform expertise.